REFERENCES

- [1] R. W. Goldsmith. “A perpetual inventory of national wealth”. In: Studies in Income and Wealth, Volume 14. NBER, 1951, 5–73.

- [2] J. G. Gurley and E. S. Shaw, (1967) “Financial structure and economic development" Economic development and cultural change 15(3): 257–268.

- [3] C. Lv, B. Bian, C.-C. Lee, and Z. He, (2021) “Regional gap and the trend of green finance development in China" Energy Economics 102: DOI: 10.1016/j.eneco.2021.105476.

- [4] M. M. Hasan, L. Yajuan, and A. Mahmud, (2020) “Regional Development of China’s Inclusive Finance Through Financial Technology" SAGE Open 10(1): DOI: 10.1177/2158244019901252.

- [5] H. Zhou and G. Xu, (2022) “Research on the impact of green finance on China’s regional ecological development based on system GMM model" Resources Policy 75:DOI: 10.1016/j.resourpol.2021.102454.

- [6] S. Xu and L. Zeng, (2021) “CORRELATION ANALYSIS OF FINANCIAL AGGLOMERATION AND REGIONAL ECONOMIC GROWTH: A NOVEL PERSPECTIVE BASED ON THE CONCEPT OF GREEN DEVELOPMENT" FRESENIUS ENVIRONMENTAL BULLETIN 30(4): 3744–3753.

- [7] H. Zhou, S. Qu, Q. Yuan, and S. Wang, (2020) “Spatial effects and nonlinear analysis of energy consumption, financial development, and economic growth in China" Energies 13(18): DOI: 10.3390/en13184982.

- [8] M. Hu, J. Zhang, and C. Chao, (2019) “Regional financial efficiency and its non-linear effects on economic growth in China" International Review of Economics & Finance 59: 193–206.

- [9] C. H. Horn and F. Feil, (2019) “Instituições financeiras de desenvolvimento regional e os desafios do Sistema Nacional de Fomento" Economia e Sociedade 28: 227–254.

- [10] M. Tang, X.Wang,W. Niu, J. Fu, and M. Zhu, (2021) “How financial development scale and R&D influence regional innovation efficiency: empirical evidence from the financial industry" Environmental Science and Pollution Research: DOI: 10.1007/s11356-021-16862-3.

- [11] D. Wang, T. Ye, S. Tian, and X. Wang, (2021) “Reexamining Spatiotemporal Disparities of Financial Development in China Based on Functional Data Analysis" Mathematical Problems in Engineering 2021: DOI: 10.1155/2021/5539035.

- [12] H. Liu, J. Long, and Z. Shen, (2021) “Financial Agglomeration, Energy Efficiency, and Sustainable Development of China’s Regional Economy: Evidence from Provincial Panel Data" Mathematical Problems in Engineering 2021: DOI: 10.1155/2021/3871148.

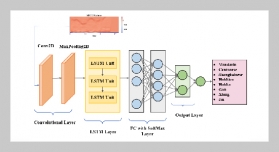

- [13] T. Laopaiboon,W. Ongsakul, P. Panyainkaew, and N. Sasidharan. “Hour-Ahead Solar Forecasting Program Using Back Propagation Artificial Neural Network”. In: 2018-October. Cited by: 4. 2019. DOI: 10.23919/ICUE-GESD.2018.8635756.

- [14] L. Yuliyanti, N. Nugraha, and Y. K. Fadilah. “The Influence of Local Own-Source Revenue towards Regional Financial Independence”. In: 1st International Conference on Economics, Business, Entrepreneurship, and Finance (ICEBEF 2018). Atlantis Press. 2019, 4–7.

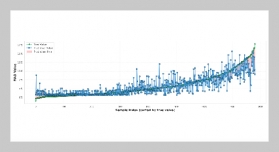

- [15] Y. Zou, D. Yang, and Y. Pan, (2021) “An improved grey Markov chain model with ANN error correction and its application in gross domestic product forecasting" Journal of Intelligent and Fuzzy Systems 40(6): 12371–12381. DOI: 10.3233/JIFS-210509.

- [16] Q. Xu, (2018) “Analysis of the Coordinated Development Mechanism of Regional Economy":

- [17] B. K. Guru and I. S. Yadav, (2019) “Financial development and economic growth: panel evidence from BRICS" Journal of Economics, Finance and Administrative Science 24(47): 113–126. DOI: 10.1108/JEFAS- 12-2017-0125.

- [18] Y. Feng and X.Wang. “The Economic Impact of Regional Financial Diversity Development in China”. In: 2016 International Conference on Contemporary Education, Social Sciences and Humanities. Atlantis Press. 2015, 192–196.

- [19] F. Ma, J. Li, H. Ma, and Y. Sun, (2022) “Evaluation of the Regional Financial Efciency Based on SBM-Shannon Entropy model" Procedia Computer Science 199: 954–961.

- [20] J. Ma. “Research on the relationship between financial development and real economic growth in Qinghai Province”. In: Cited by: 0. 2019, 614–619. DOI: 10.1109/ICEMME49371.2019.00126.

- [21] Y. Qiao and C. Guo, (2020) “Evaluation Model of Financial Resource Allocation Efficiency in Coastal Areas Based on Supply Chain" Journal of Coastal Research 103(sp1): 186–189. DOI: 10.2112/SI103-040.1.

- [22] C. Wang, X. Zhang, P. Ghadimi, Q. Liu, M. K. Lim, and H. E. Stanley, (2019) “The impact of regional financial development on economic growth in Beijing–Tianjin–Hebei region: A spatial econometric analysis" Physica A: Statistical Mechanics and its Applications 521: 635–648. DOI: 10.1016/j.physa.2019.01.103.

- [23] H. Zhuang, H. Yin, M. Wang, and J. Yang, (2019) “Bank efficiency and regional economic growth: Evidence from China" Annals of Economics and Finance 20(2): 661–689.

- [24] F. di Pietro, M. E. Bontempi, M.-J. Palacín-Sánchez, and R. Samaniego-Medina, (2019) “Capital structure across Italian regions: The role of financial and economic differences" Sustainability (Switzerland) 11(16): DOI: 10.3390/su11164474.

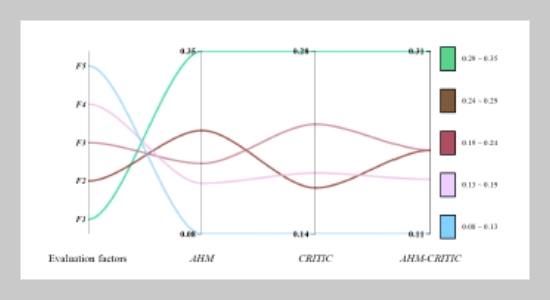

- [25] C. Qiansheng, (1997) “Analytic hierarchy process (AHP) and attribute hierarchical model (AHM)" Systems Engineering-Theory & Practice 17(11): 25–29.

- [26] S. Hemalatha, L. Dumpala, and B. Balakrishna, (2018) “Service quality evaluation and ranking of container terminal operators through hybrid multi-criteria decision making methods" Asian Journal of Shipping and Logistics 34(2): 137–144. DOI: 10.1016/j.ajsl.2018.06.010.

- [27] N. Yu, F. Li, X. Han, J. Hu, Y. Gao, D. Li, and Y. Liu, (2020) “Comprehensive evaluation model of decommissioned battery for electric vehicles based on ahp-critic" Lecture Notes in Electrical Engineering 585: 103–114. DOI: 10.1007/978-981-13-9783-7_9.

- [28] T. Liu, N. Zhou, Q.Wu, D.Wang, and X. Hu, (2022) “Toward a sustainable energy system in China: Status and influencing factors" Energy Exploration and Exploitation 40(2): 580–598. DOI: 10.1177/01445987211054224.

- [29] H. Zhang, X. Bai, and X. Hong, (2022) “Site selection of nursing homes based on interval type-2 fuzzy AHP, CRITIC and improved TOPSIS methods" Journal of Intelligent and Fuzzy Systems 42(4): 3789–3804. DOI: 10.3233/JIFS-212010.

- [30] Y.Wu, Z. Ma, X. Li, L. Sun, S. Sun, and R. Jia, (2021) “Assessment of water resources carrying capacity based on fuzzy comprehensive evaluation – Case study of Jinan, China" Water Science and Technology: Water Supply 21(2): 513–524. DOI: 10.2166/ws.2020.335.

- [31] F. B. Banadkooki, V. P. Singh, and M. Ehteram, (2021) “Multi-timescale drought prediction using new hybrid artificial neural network models" Natural Hazards 106(3): 2461–2478. DOI: 10.1007/s11069-021-04550-x.

- [32] Y. Chen, (2021) “BP Neural Network Based on Simulated Annealing Algorithm Optimization for Financial Crisis Dynamic Early Warning Model" Computational Intelligence and Neuroscience 2021: DOI: 10.1155/2021/4034903.

- [33] D. A. Adeyinka and N. Muhajarine, (2020) “Time series prediction of under-five mortality rates for Nigeria: comparative analysis of artificial neural networks, Holt-Winters exponential smoothing and autoregressive integrated moving average models" BMC Medical Research Methodology 20(1): DOI: 10.1186/s12874-020-01159-9.

- [34] Y. Zeng, J. Dong, Z. Ji, C. Yang, and Y. Liang, (2021) “A Linear regression model for the prediction of rice sheath blight field resistance" Plant Disease 105(10): DOI: 10.1094/PDIS-08-20-1681-RE.

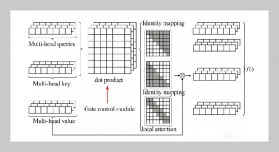

- [35] G. Tüysüzo˘ glu, D. BïRant, and V. Kirano˘ glu, (2022) “Temporal bagging: a new method for time-based ensemble learning" Turkish Journal of Electrical Engineering and Computer Sciences 30(1): 279–294. DOI: 10.3906/elk-2011-41.

- [36] G. Tuysuzoglu and D. Birant, (2020) “Enhanced bagging (eBagging): A novel approach for ensemble learning" International Arab Journal of Information Technology 17(4): 515–528. DOI: 10.34028/iajit/17/4/10.

- [37] Q. Jiang, X. Zhang, Q. Lin, G. Chen, R. Zhang, and S. Liu, (2020) “Internet Penetration and Regional Financial Development in China: Empirical Evidence Based on Chinese Provincial Panel Data" Scientific Programming 2020: DOI: 10.1155/2020/8856944.